Date of event: Friday, October 13, 2023

Where: Online

Description:

The ESCWA Financial Inclusiveness Index (FII) combines both supply-side data (collected from financial service providers through reporting to central banks and/ or regulators, like the International Monetary Fund Financial Access Survey [1]), demand-side data (collected from financial services users through surveys like the World Bank’s Global Findex [2] data) along with separate sections to understand digital inclusion [3], and the role of technology (International Telecommunication Union (ITU) [4]).

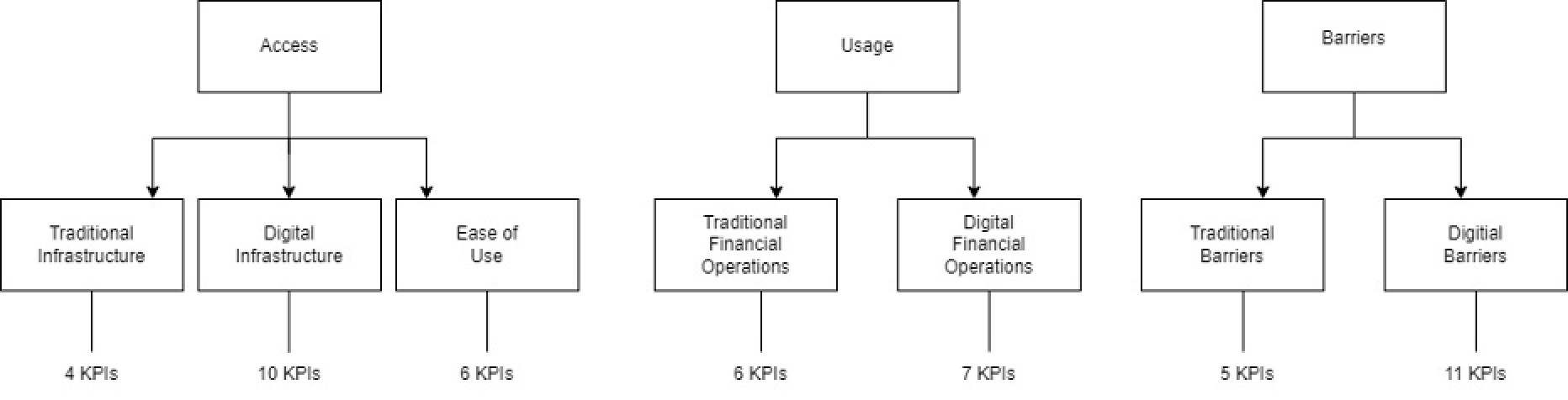

The FII is a tool used to measure the level of access to financial services within a population. The index aims to capture the extent to which individuals and small businesses have access to and use financial services but also to identify the barriers that prevent them from accessing and using financial services. The FII end goal is to provide policymakers with a comprehensive measure of financial inclusiveness and help them spot the areas where interventions are needed to improve financial inclusion. The FII is a multi-dimensional concept. ESCWA’s Financial Inclusiveness Index comprises three main pillars:

- The access pillar measures the availability and accessibility of financial services: in addition to infrastructure (traditional, digital) this pillar also tracks the ease of use.

- The usage pillar measures how extensively financial services are used by the population; and

- The barriers pillar measures the obstacles that prevent individuals and businesses from accessing and using financial services.

Each of these pillars separately includes a digital and traditional dimension as well.

The forty-nine individual indicators included in the FII were chosen based on relevance, availability, timeliness, and reliability of the data. Of these, 14 indicators are hard/quantitative data, 2 are index/composite indicator data, and 33 are survey/qualitative data.

The FII was computed for 139 countries, with country coverage subject to data availability. The computation of the FII was computed in two steps. Scores are aggregated, firstly, at the sub-pillar level, secondly, at the pillar level as follow:

- Access subindex = (Traditional infrastructure score + Digital Infrastructure score + Ease of access score) ÷ 3

- Usage subindex = (Traditional Financial operations score + Digital Financial operations score) ÷ 2.

- Barriers subindex = (Traditional Barriers score + Digital Barriers score) ÷ 2.

Lastly, the overall index is computed by aggregating scores across pillars using an unweighted arithmetic average.

A picture containing diagram, line, text, plan Description automatically generated

Societal impact:

Financial inclusiveness can have several significant societal impacts among which:

- Poverty reduction: Financial inclusion enables people from low-income and marginalized communities to access savings accounts, credit, insurance, and other financial products. This can help them build assets, invest in education, start businesses, and protect themselves from economic shocks, ultimately reducing poverty and income inequality.

- Economic growth: By bringing more people into the formal financial system, financial inclusiveness can stimulate economic growth. When individuals and businesses have better access to credit and other financial tools, they can invest in productive ventures, create jobs, and contribute to economic development.

- Women empowerment: In many societies, women face more significant barriers to financial access and are often excluded from formal financial systems. Financial inclusiveness can help empower women by providing them with financial independence, enabling them to make independent financial decisions, and supporting their economic participation.

- Education and healthcare improvements: Increased access to financial services can lead to better access to education and healthcare. Families can save and plan for their children's education, and individuals can access insurance products to protect themselves from health-related financial crises.

- Reduction in informal lending: In many developing countries, people resort to informal lenders who often charge exorbitant interest rates, trapping borrowers in debt cycles. Financial inclusion can reduce reliance on such informal lending and promote responsible lending practices.

- Social safety nets: Financial inclusiveness can facilitate the delivery of social welfare programs, such as conditional cash transfers, pensions, and subsidies. Digital financial tools can help streamline and target these programs, reducing leakage and ensuring more effective delivery.

- Financial literacy: As financial services become more accessible, there is also an opportunity to improve financial literacy among the population. Educating people about managing money, budgeting, and making informed financial decisions can lead to more responsible use of financial products and services.

- Reduction in cash transactions: Promoting digital financial services can reduce the reliance on cash transactions, which can help combat corruption, tax evasion, and money laundering. It can also increase transparency and contribute to the formalization of the economy.

- Fostering entrepreneurship: Financial inclusiveness can support entrepreneurs and small businesses by providing them with the necessary capital and financial tools to start and expand their ventures. This, in turn, can spur innovation and job creation.

- Social cohesion and stability: When people feel financially included and have a stake in the economy, it can foster social cohesion and reduce economic disparities. This may contribute to increased stability and reduce the likelihood of social unrest and conflicts.

Overall, financial inclusiveness is a crucial element in achieving sustainable development goals and creating a more equitable and prosperous society. However, achieving widespread financial inclusiveness requires concerted efforts from governments, financial institutions, civil society, and the private sector to overcome barriers like inadequate infrastructure, regulatory challenges, and financial illiteracy.

| Originally Published | 07 Aug 2023 |

| Knowledge service | Metadata | Composite Indicators |