The global economy is experiencing a number of turbulent challenges. Inflation higher than seen in several decades, tightening financial conditions in most regions, Russia’s invasion of Ukraine, and the lingering COVID-19 pandemic all weigh heavily on the outlook. Normalization of monetary and fiscal policies that delivered unprecedented support during the pandemic is cooling demand as policymakers aim to lower inflation back to target. But a growing share of economies are in a growth slowdown or outright contraction. The global economy’s future health rests critically on the successful calibration of monetary policy, the course of the war in Ukraine, and the possibility of further pandemic-related supply-side disruptions, for example, in China.

Global growth is forecast to slow from 6.0 percent in 2021 to 3.2 percent in 2022 and 2.7 percent in 2023.

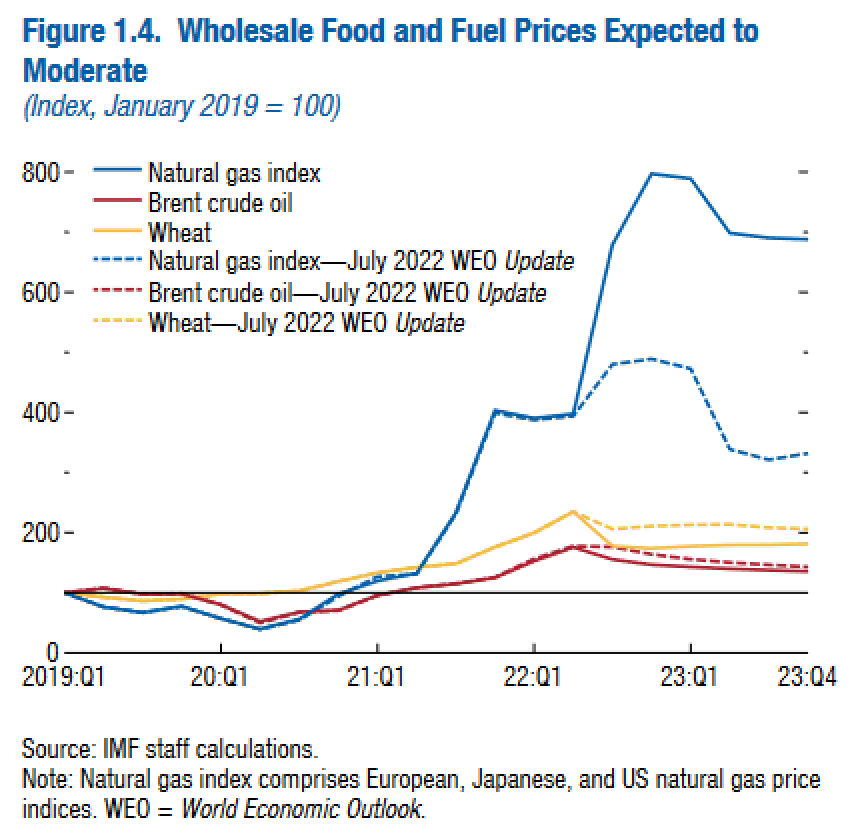

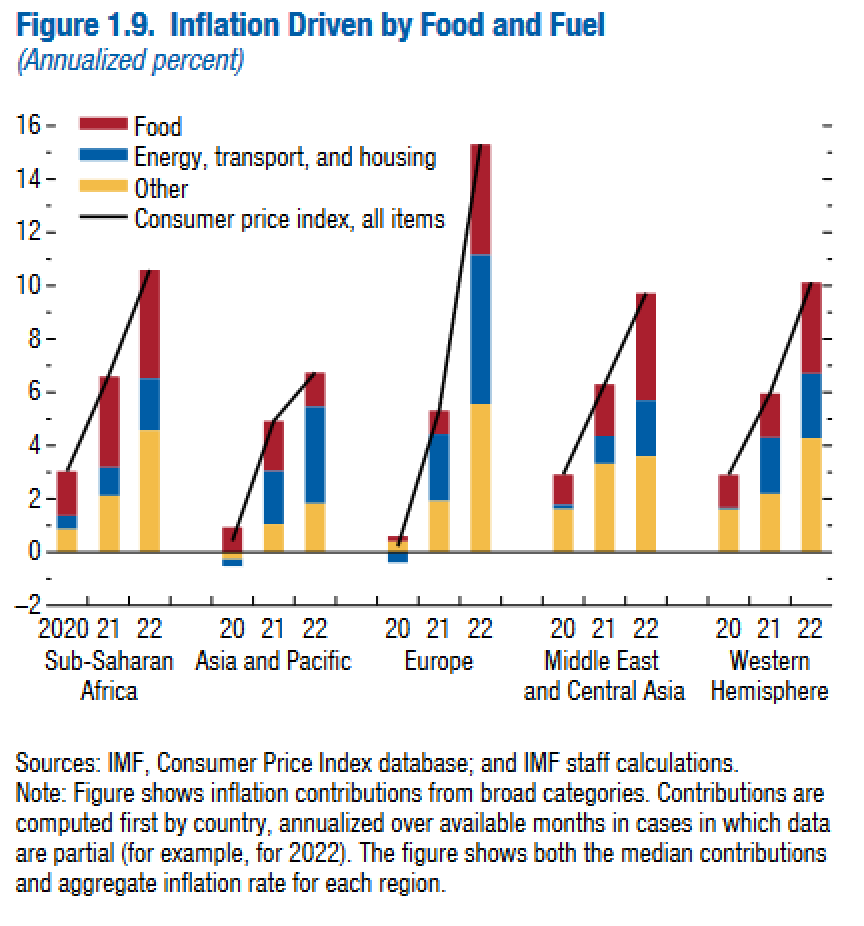

Global inflation is forecast to rise from 4.7 percent in 2021 to 8.8 percent in 2022 but to decline to 6.5 percent in 2023 and to 4.1 percent by 2024 Upside inflation surprises have been most widespread among advanced economies, with greater variability in emerging market and developing economies.

Risks to the outlook remain unusually large and to the downside. More energy and food price shocks might cause inflation to persist for longer Global tightening in financing conditions could trigger widespread emerging market debt distress Halting gas supplies by Russia could depress output in Europe. A resurgence of COVID-19 or new global health scares might further stunt growth. A worsening of China’s property sector crisis could spill over to the domestic banking sector and weigh heavily on the country’s growth, with negative cross-border effects.

Fiscal policy’s priority is the protection of vulnerable groups through targeted near-term support to alleviate the burden of the cost-of-living crisis felt across the globe. But its overall stance should remain sufficiently tight to keep monetary policy on target. Addressing growing government debt distress caused by lower growth and higher borrowing costs requires a meaningful improvement in debt resolution frameworks.

The war in Ukraine

The war in Ukraine is also having global consequences for food prices. Despite the recent agreement on Black Sea grain exports, global food prices remain elevated, although they are expected to soften somewhat. The chapter’s Special Feature, “Commodity Market Developments and Food Inflation Drivers” points to supply-side factors dominating current food price dynamics, compounded by the export restrictions several countries have implemented. Overall, international inflation has moved higher, propelled by further increases in consumer energy and food prices, as the war has led to a broadening of inflationary pressures. Countries with diets tilted toward foods with the largest price gains, especially wheat and corn; those more dependent on food imports; and those with diets including sizable quantities of foods with large pass-throughs from global to local prices have suffered most. Low-income countries whose citizens were already experiencing acute malnutrition and excess mortality before the war have suffered a particularly severe impact, with especially serious effects in sub-Saharan Africa, as food accounts for about 40 percent of that region’s consumption basket, on average, and the pass-through from global to domestic food prices is relatively high at 30 percent (April 2022 Regional Economic Outlook: Sub-Saharan Africa).

Growth in the emerging market and developing economy group is expected to decline to 3.7 percent in 2022 and remain there in 2023, in contrast to the deepening slowdown in advanced economies.

For emerging market and developing economies, inflation is expected to rise from 5.9 percent in 2021 to 9.9 percent in 2022, before declining to 8.1 percent in 2023.

Should inflation remain elevated, further policy tightening in advanced economies may add pressure to borrowing costs for emerging market and developing economies. If sovereign spreads increase further, or even just remain at current levels for a prolonged period, debt sustainability may be at risk for many vulnerable emerging market and developing economies, particularly those hit hardest by energy and food price shocks. With a larger import bill, strained fiscal budgets, and limited fiscal space, any loss of access to short-term funding markets will have significant economic and social consequences. The poor are particularly vulnerable, as fiscal policy support is critical to shielding them from the impact of the food inflation shock.

The report contains a special feature on commodity market developments and food inflation drivers.

International food prices are estimated to have added 5 percentage points to food price inflation for the average country in 2021 and are forecast to add an estimated 6 percentage points in 2022 and 2 percentage points in 2023. A combination of supply-side factors (the 2020–22 La Niña episode and food trade restrictions), cereal-specific demand (China’s 2021 restocking), low interest rates, and more recently, the war in Ukraine and the Russian blockade of wheat exports from Ukraine created a perfect storm for global food commodity markets that kept prices on an upward trajectory between April 2020 and May 2022.

The outlook for domestic food price inflation remains uncertain, as global food prices could surprise again on the upside, given the high uncertainty about the impact of the war in Ukraine and weather events and the delayed effect of high fertilizer prices. Current estimates already suggest a negative shock for global cereal production equivalent to about a 0.6 standard deviation in cereal growth for 2022 (OECD-FAO, 2022)—contributing to a 23 percent rise in cereal prices this year and outweighing the effects of higher interest rates on food price inflation.

Finally, differences in the timing and magnitude of the price pass-through make low-income and high-food-openness countries more susceptible to a resumption of the global food price rally. Recent events underscore the importance of well-functioning international food markets and of appropriate (domestic) policies to address inevitable price swings, including targeted food aid to vulnerable consumers as well as incentives for the buildup of global food stocks over the medium term. Open food trade raises consumer variety, promotes deeper and more stable markets, and constitutes a hedge against the volatility of domestic production. Policies that promote self-sufficiency weaken the world food trading system and raise environmental costs through land conversion or more intensive farming practices. Especially for small countries (because of within-country spatial correlation of weather patterns), densely populated countries, and countries particularly vulnerable to climate change, international trade will remain indispensable.

Login (or register) to follow this conversation, and get a Public Profile to add a comment (see Help).

28 Oct 2022

EU4Algae Webinar Series: Towards a Roadmap for the EU Algae Industry!

AMIS Market Monitor March 2025

Flagship Report 2025 - CGIAR

Share this page