Highlights

The global economy remains in a precarious state amid the protracted effects of the overlapping negative shocks of the pandemic, the Russian Federation’s invasion of Ukraine, and the sharp tightening of monetary policy to contain high inflation. Global growth is projected to slow significantly in the second half of this year, with weakness continuing in 2024. Inflation pressures persist, and tight monetary policy is expected to weigh substantially on activity. Recent banking sector stress in advanced economies will also likely dampen activity through more restrictive credit conditions. The possibility of more widespread bank turmoil and tighter monetary policy could result in even weaker global growth. Rising borrowing costs in advanced economies could lead to financial dislocations in the more vulnerable emerging market and developing economies (EMDEs).

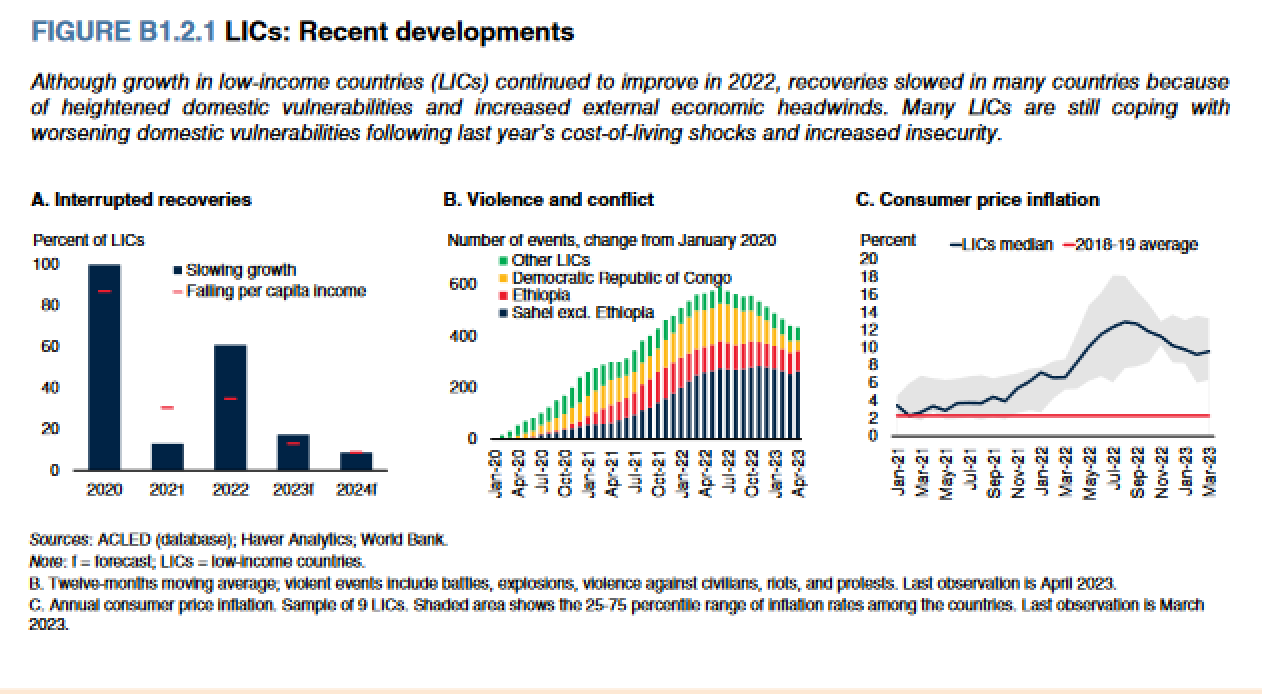

In low-income countries, in particular, fiscal positions are increasingly precarious. Comprehensive policy action is needed at the global and national levels to foster macroeconomic and financial stability. Among many EMDEs, and especially in low-income countries, bolstering fiscal sustainability will require generating higher revenues, making spending more efficient, and improving debt management practices.

Continued international cooperation is also necessary to tackle climate change, support populations affected by crises and hunger, and provide debt relief where needed. In the longer term, reversing a projected decline in EMDE potential growth will require reforms to bolster physical and human capital and labor-supply growth.

Fiscal Policy Challenges in Low-Income Countries

The room for fiscal policy to maneuver has narrowed in low-income countries (LICs) over the past decade: LIC debt has grown rapidly as sizable and widening deficits offset the debt-reducing effects of growth. Fiscal deficits have reflected growing spending pressures, including on debt service, amid persistent revenue weakness, especially for grants and income tax revenues. As a result, 14 out of the 28 LICs were assessed as being in debt distress or at a high risk of debt distress as of end-February 2023. Creating room for fiscal policy requires generating higher revenues, making spending more efficient, and improving debt management practices. These measures need to be embedded in improvements to domestic institutional frameworks and supported by well-coordinated global policies both to improve fiscal policy management and to address debt challenges.

While agricultural prices are expected to moderate this year, worsening conflicts or adverse weather-related events could reduce agricultural output, push up food prices anew, and exacerbate enduring food security challenges, especially in Middle East and North Africa, South Asia, and Sub-Saharan Africa. This could feed further social unrest and conflict.

| Year of publication | |

| Geographic coverage | Global |

| Originally published | 07 Jun 2023 |

| Related organisation(s) | World Bank |

| Knowledge service | Metadata | Global Food and Nutrition Security | Food security and food crises | indebtednessLower middle income country |

| Digital Europa Thesaurus (DET) | fiscal policyeconomic analysisinflationConflictclimate change |