The war in Ukraine and aftershocks from the COVID-19 pandemic present Emerging Market and Developing Economies (EMDEs) with an extremely challenging external environment shaped by sharply higher food, fertilizer, and energy prices, rising interest rates and spreads, and stagflation risk in advanced economies. These shockwaves have hit when many countries are still struggling with the health and COVID-19 pandemic’s economic fallout, including stresses on fiscal and monetary policy. These external shocks create new fiscal pressures and set back fiscal recovery efforts. The economic crisis in Sri Lanka in 2022, as well as other countries on the verge of crisis, illustrates the importance of securing fiscal sustainability in the face of new fiscal pressures. This note highlights the shocks’ fiscal impacts on EMDEs, discusses strategies for fiscal responses, and identifies countries at greatest risk.

Fiscal Impacts of the Deteriorating Global Economic Environment

Rising food and energy prices. Food and energy prices have reached record levels. Between January 2020 and March 2022, food prices rose 68 percent and energy prices 116 percent. Although prices have since fallen from their peak, they are consistent with a trend since the start of the pandemic of steadily increasing. These price increases have major adverse impacts on businesses and households, including increased risks of food insecurity and hunger in many EMDEs. They also represent a major fiscal challenge. For countries with energy and food subsidy schemes, these extreme price movements can result in significant increases in the cost of these subsidies. Many governments are considering or have already adopted new policies to mitigate the adverse impacts of these price increases on households and businesses. Targeting is essential to ensure fiscal sustainability and affordability while providing adequate support to the most vulnerable.

Higher interest rates. Public debt and broader fiscal risks have increased significantly since the onset of the COVID-19 pandemic and have been worsened by the war in Ukraine. For low-income countries, the increase was from 43.6 percent to 49.8 percent of GDP (IMF 2022). Central banks are now tightening monetary policy to fight inflation, and interest rates are rising. This has major fiscal implications for countries with elevated debt levels, which face increasing debt service costs, with interest expenditures crowding out other expenditures, increased re-financing risks, and higher risk of debt distress.

Slower growth. Recent World Bank growth projections for developing economies suggest the war will contribute to a cumulative GDP loss of about 3 percent in 2022 and 2023. Projected losses are particularly high for countries in the Europe and Central Asia (ECA) region, which have close economic ties to Russia and Ukraine, and for many small island states.

The slowing of the economic recovery from the COVID-19 pandemic translates into a weaker fiscal recovery, especially on the revenue side. In particular, EMDEs face adverse consequences, with growth projected to remain below and primary fiscal deficits above pre-pandemic projections in the medium term. Some net exporters of energy, food, and other commodities will benefit from price increases.

A highly uncertain outlook. The unpredictable evolution of the war in Ukraine and of energy and food prices, the potential reduction of Russian gas supplies to European economies, which would result in a major recession, the cost and burden sharing of eventual reconstruction of Ukraine, lingering COVID-19 pandemic risks in the form of new outbreaks and virus mutations, and the extent of monetary tightening needed to rein in inflation create major uncertainties for the global economic outlook and the fiscal outlook for EMDEs. These uncertainties imply that the adverse global economic environment may persist for longer or even deteriorate further, potentially higher cost of fiscal mitigation measures, a further deterioration of the fiscal situation, and more rapidly dwindling fiscal space in EMDEs. Fiscal policy design needs to reflect this high degree of uncertainty through a conservative approach in the design of fiscal mitigation measures to ensure that these can be sustained and to preserve fiscal space for the risk of a potentially prolonged and further deteriorating global economic environment.

Country Vulnerabilities and Fiscal Space

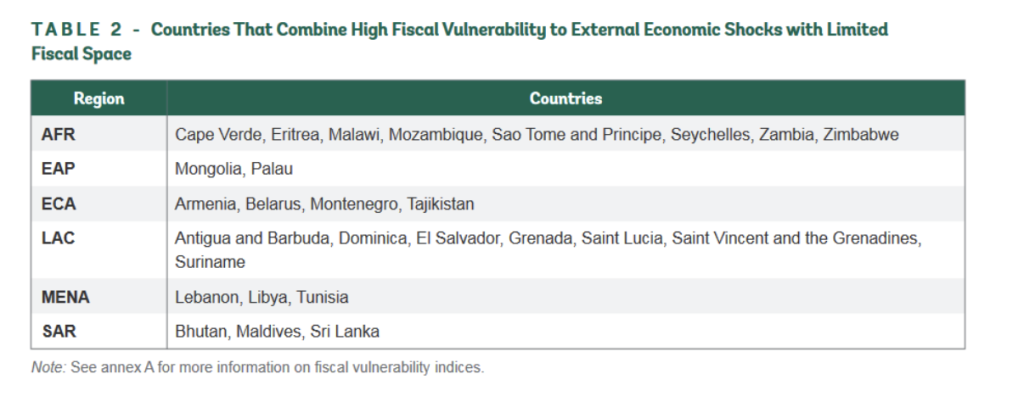

Small states and African economies are most likely to combine high fiscal vulnerability to at least one external economic shock with low fiscal space. Many countries display vulnerability to multiple external economic shocks, and they are likely to experience extraordinarily strong fiscal pressures and needs for external assistance in the current environment.

Fiscal Responses

This note highlights several issues that countries should consider in designing their fiscal response to the spillovers of the war.

-

Ensure economy of crisis mitigation measures

-

Retain fiscal space to be able to sustain measures for an extended period

-

Avoid a multiplicity of measures and prioritize

-

Avoid excessive interference with price signals

-

Avoid tax measures as an instrument to mitigate the impact of price increases

-

Avoid restrictions on trade

-

Review subsidy programs

-

Energy sector interventions should not undermine climate objectives

-

Developing countries may need support by the international community

-

Crises provide opportunities for reform

-

Pursue structural reforms to foster green, resilient, and inclusive development

| Year of publication | |

| Publisher | International Bank for Reconstruction and Development / The World Bank |

| Geographic coverage | Global |

| Originally published | 14 Oct 2022 |

| Related organisation(s) | World Bank |

| Knowledge service | Metadata | Global Food and Nutrition Security | Food security and food crises | Food price crisis |

| Digital Europa Thesaurus (DET) | inflationfiscal policyprice of energypolicymakingdeveloping countrieswar in Ukraine |