Highlights:

Agricultural prices were broadly unchanged between the final quarter of 2022 and the first quarter of 2023—at 14 percent below their April 2022 peaks. Renewal of the Black Sea Grain Initiative continued to help grain exports from Ukraine reach global markets. The initiative, better harvests in other major grain-producing countries, and lower energy prices, have helped reduce agricultural commodity prices from their early-2022 peaks. Grain prices fell 5 percent in the first quarter of 2023, while prices of most other food commodities rose slightly. In real terms, food prices continue to remain above levels observed during the 2007-08 food crisis (figure 1.D).

Elevated food prices contribute to higher food insecurity, with severe implications for poorer populations in many developing economies. Annual domestic food price inflation across 146 countries averaged 20 percent in February 2023, the highest level over the past two decades. Of those, nine out of ten low- and middle-income countries face food price inflation above 5 percent.

Agricultural prices are projected to decline 7 percent in 2023 and ease further in 2024. Food prices are expected to fall by 8 percent in 2023 and 3 percent in 2024, assuming that grain and oilseed exports from the Black Sea region will remain stable. Nevertheless, real food prices in 2023 will remain at their second highest levels since 1975—exceeded only by 2022.

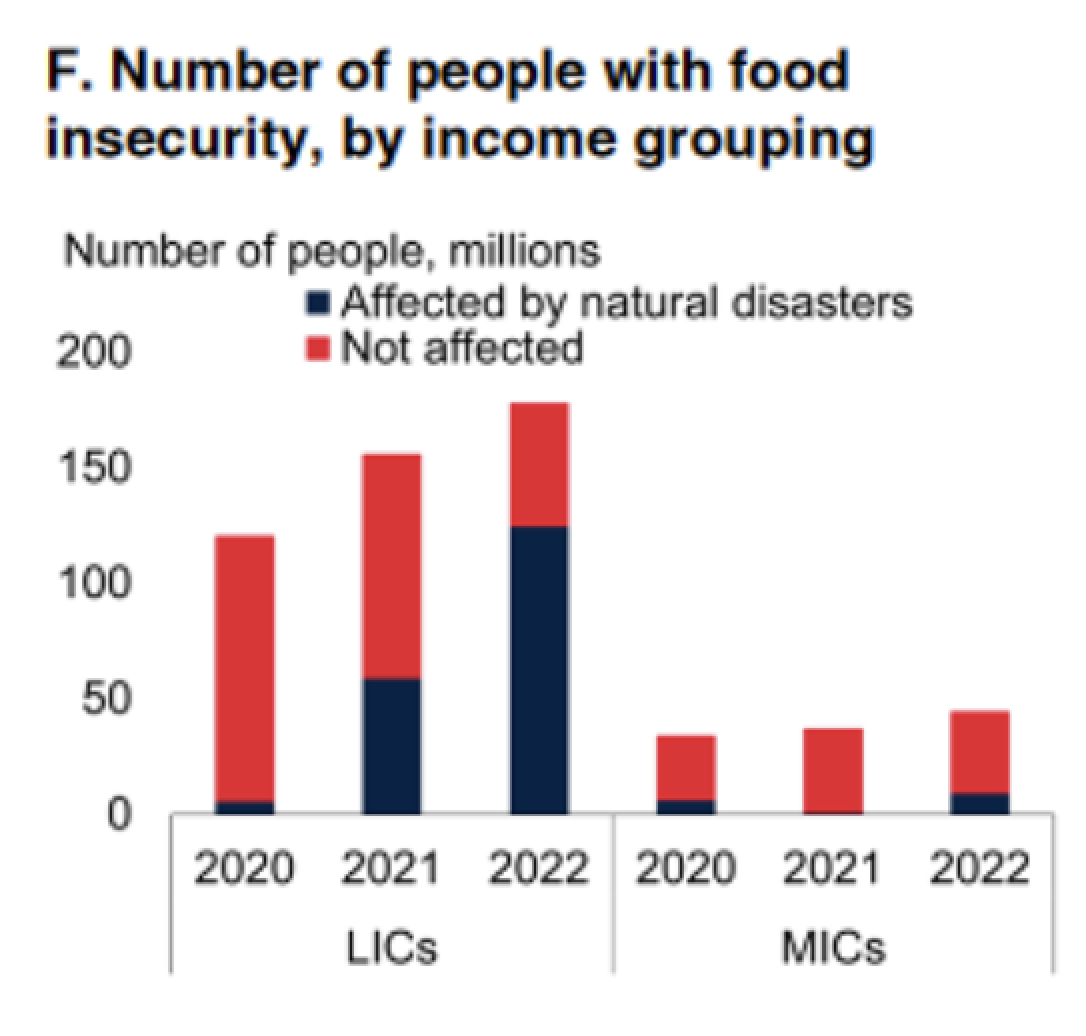

More than 349 million people globally are projected to face food insecurity this year—double the number in 2020—because of high food and fertilizer prices, conflicts, and economic and climate shocks (WFP 2023). The prevalence of natural disasters is associated with a significant increase in the number of food insecure house- holds, particularly in low-income countries (figure 1.F).

Prices for agricultural raw materials, which include cotton, timber, and rubber, will decline by about 6 percent in 2023, reflecting sluggish global industrial demand growth, and rebound by 2 percent in 2024 as China’s demand picks up.

| Year of publication | |

| Geographic coverage | Global |

| Originally published | 02 May 2023 |

| Related organisation(s) | World Bank |

| Knowledge service | Metadata | Global Food and Nutrition Security | Food security and food crises | Food and nutrition securityAccess to foodFood price crisis |

| Digital Europa Thesaurus (DET) | agricultural marketMonitoringprice of agricultural producefertiliserwar in Ukraineeconomic analysis |